La finance de l’économie bleue

La finance vertueuse de la « Blue Economy »

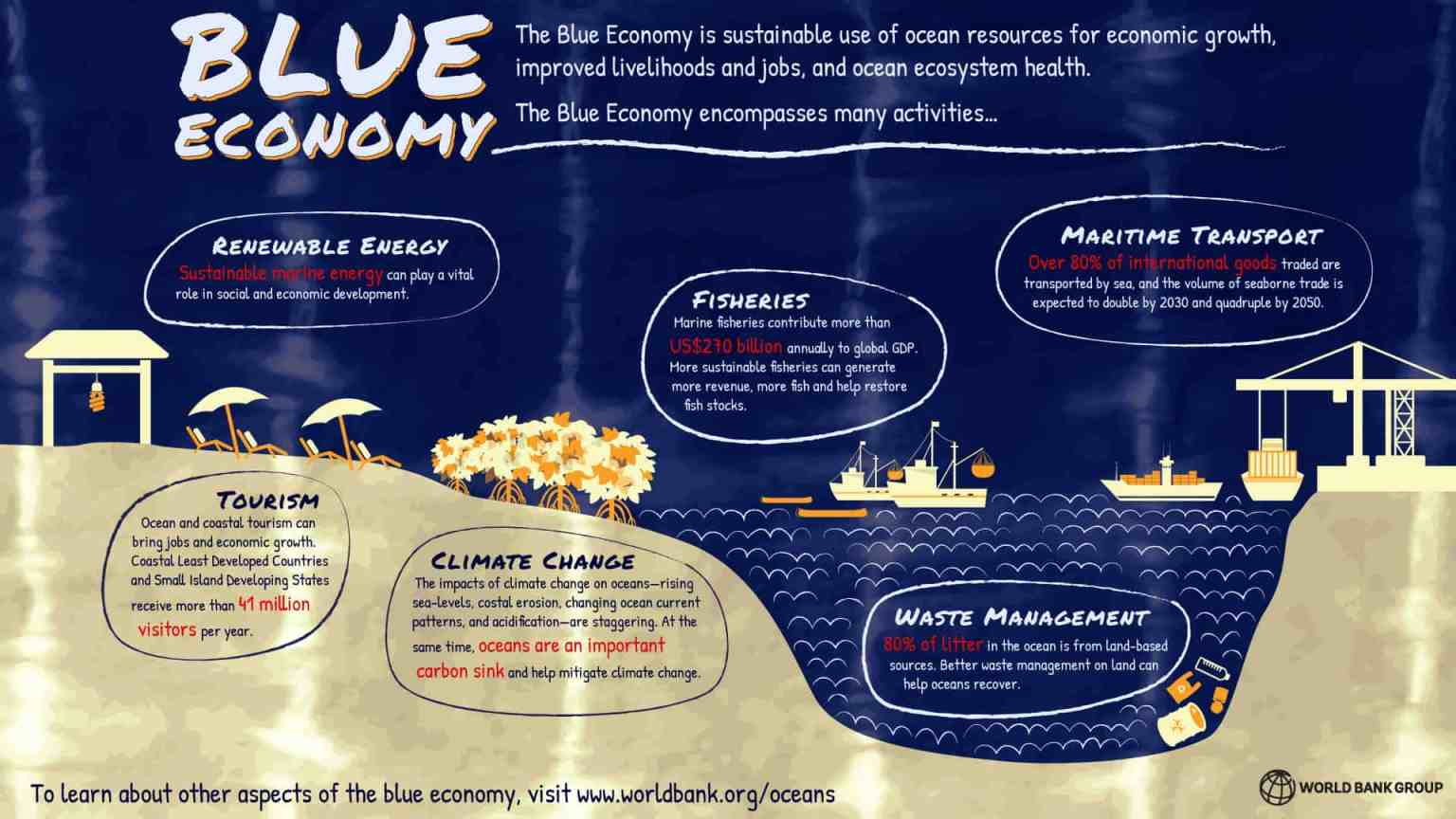

Un marché mondial qui croit 2 fois plus que le marché terrestre pour les 10 prochaines années, des groupes internationaux leaders qui s’organisent pour la transition écologique, des start-up qui « scale-up » et impactent, des challenges technologiques à relever, des laboratoires et des chercheurs réputés, des coopérations internationales, des investisseurs en dette et en capital, des normes internationales, des metrics d’impact, un engouement mondial pour l’écologie…et des jeunes managers plein d’énergie, de passion et d’innovation. Les Océans ne sont plus réservés uniquement aux aventuriers navigateurs, et leur protection n’est plus l’apanage d’un groupe de militants. Des énergies renouvelables, à l’aquaculture, en passant par la valorisation des plastiques, l’Océan devient la source d’une jeune industrie vertueuse en pleine croissance, dont le marché des 5 principaux secteurs est estimé à $3 trillion par la banque mondiale en 2019.

Cette « blue economy » est assez fragmentée: des investissements énormes sont nécessaires pour les infrastructures (les parcs éoliens, les transitions énergétiques pour le transport maritime, la pollution par les plastiques…), des investissements plus faibles suffisent pour les projets locaux qui peuvent aussi impacter (les réserves marines, les fermes seaweed, l’innovation dans l’aquaculture,….)

Dans cette deuxième tranche de projets, le milieu financier privé se structure à l’image de l’industrie traditionnelle et start-upienne.

Protection côtière rentable…donc durable!

Pour motiver un investisseur, il faut lui donner des modèles de business rentables à terme, des benchmark financiers, des assurances de liquidité. Mais les projets écologiques sont souvent portés par des associations qui peuvent bénéficier plus facilement de dons et de subventions publiques. Du coup, les business model associés n’existent pas ou ne sont pas optimisés. Sauf que….on peut associer Ecologie des Océans et business équilibré voire rentable. C’est la mission que s’est donné la société Française « Blue Finance » en montant des projets rentables pour le management des aires marines protégées (MPAs en anglais).

Imaginez les parc marins des calanques, de port-cros, de l’iroise, de la côte d’opale….qui s’équilibrent financièrement et économisent des dizaines de M€ de crédits d’Etat (une moyenne de 6 ME annuel par Parc) . Après une phase d’étude économique, Blue Finance définit un business plan pour l’AMP concernée, en valorisant ses actifs: tourisme, activités nautiques, pêche, énergie renouvelable,…Ce document lui permet de construire l’ingénierie financière – public/privée pour les investissements initiaux. Ensuite, Blue Finance assiste l’AMP dans sa gestion pour garantir l’exécution du plan. Blue Finance a conclu un premier AMP sous management en République Dominicaine (800 000 ha- en comparaison, Port-cros c’est 3 000 ha), et est en cours de signature de 5 autres AMPs. La preuve que Ecologie et Business ne sont pas antinomiques.

Crowdfunding

Les plateformes de Crowdfunding sont apparues pour permettre à tout un chacun d’investir très tôt dans des projets/entreprises que l’on souhaite soutenir. A l’image des plateformes connues comme Wiseed, Indigogo, kickstarter…qui peuvent lever plusieurs centaines de milliers d’euros par projets, Mael Prud’homme a lancé en 2015, la plateforme de financement participatif ekosea pour les start-up de la mer. Avec 146 projets financés depuis 2015, 800 kE levés, 10 000 contributeurs et un taux de réussite de 85%, Mael a aussi l’ambition de lever des fonds pour sa plateforme pour mieux professionnaliser le monde des start-up de la mer, améliorer son soutien et ses conseils pour les projets: n’hésitez pas à le soutenir dans sa démarche d’ouverture de son capital. De dimension plus modeste que ces grandes cousines, cette plateforme ekosea permet d’encourager la création d’entreprises et participe à l’élan collectif pour la protection des Océans.

Seed et Series A

Apres ces premiers financements, les start-up peuvent poursuivre leur croissance en s’adressant à des investisseurs professionnels.

- Business Angels: un groupe d’entrepreneurs a fondé l’association « mer angels » pour financer les projets de l’économie maritime qui représente 14% du PIB. Bien que les critères de protection des Océans ne soit pas un pré-requis pour leurs investissements, Mer Angels sera sensible à tous projets maritime qui y participe.

- Accelerateur/incubateur: L’association californienne SOA (Sustainable Ocean Alliance), fondée par la jeune CEO Daniela Fernadez, développe 2 programmes d’accélération: former des leaders pour diriger des projets Océans (c’est le thème « éducation »), et incuber des start-up qui relèvent le défi de sauver les Océans. Cet incubateur, lancé en 2018, a déjà accueilli plus de 15 start-up. Supporté par des managers médiatiques, comme le patron de Salesforce, Marc Benioff, SOA veut pouvoir incuber 100 start-up d’ici à fin 2021. Une sorte de « station F » pour les Océans et à la mode Californienne. Même si vous n’êtes pas Californien, vous pouvez soumettre votre projet à l’équipe de SOA: il n’y a pas de discrimination nationale dans le défi de sauvetage des Océans!

- VC (venture capitalist): la formidable croissance des start-up Californiennes a engendré un fort engouement pour ce type d’entreprise de la part des investisseurs Français. Les VCs investissent dans l’innovation, d’usage ou technologique, et les projets qui peuvent se déployer à grande échelle et se vendre à terme. Un premier VC francais s’est constitué en 2019, pour adresser les projets de protection des océans sur 2 thématiques principales: l’industrie des seaweed (algues marines) et l’aquaculture. Blue Oceans Partners a déjà réalisé 2 investissements en capital dans 2 projets qui respectent les contraintes SDG14 des Nations Unies. Leur process d’investissement est en tout point identique aux « autres » VCs: augmentation de capital, négociation d’un pacte d’actionnaire, présence au sein de la gouvernance,….On ne peut que leur souhaiter de belles sorties pour augmenter l’appétit des investisseurs pour les projets qui participent au SDG14.

Series B, C,…et autres

Enfin, lorsque l’entreprise devient rentable ou que le projet réclame des investissements plus conséquents, d’autres types d’investisseurs prennent le relais. Il peut être nécessaire de structurer des tours de table de type Series B ou C ou utiliser des montages financiers bancaires.

- Adiant Capital: Initialement dans le business du Carbone, Adiant (Suisse) se diversifie et s’intéresse aux projets qui oeuvrent pour la protection des Océans. Plus de 3 MdE investit en 8 ans, Adiant est un investisseur « patient » et ayant une solide expérience des projets durables.

- Althelia: Cet investisseur (UK) a crée un fond spécifique pour les Océans, « sustainable ocean fund » de $100M. Le SOF bénéficie de garantie d’un fond souverain et de souscripteurs de la sphère publique. Il intervient dans les projets traitant la pollution des plastiques, ou de la pêche durable. Cet investisseur compte investir dans 15 à 20 projets en 8 ans.

Et les Banques?

Les banques interviennent classiquement en dette. Pour les entreprises privées, il faut démontrer une capacité à rembourser cette dette et donc montrer, à minima, un résultat d’exploitation positif. Ou sinon, il leur faudra des cautions et « colateraux » solides. Ces critères de bon sens excluent naturellement les jeunes projets ou start-up.

Cependant, on peut noter les efforts des banques françaises pour intégrer dans leurs stratégies de RSE, les critères du SDG14. Société générale, CIC, Crédit Agricole, BNP Paribas ont adhéré aux règles « Poséidon ». Ces règles visent à réduire les gaz à effet de serre et à décarboner le transport maritime: objectif de réduction de 50% à l’horizon 2050. Ainsi, leurs soutiens financiers seront soumis à l’évaluation des efforts de réduction des émissions de CO2 de leurs clients maritimes.

Enfin, on peut noter aussi les efforts de BNP Paribas, qui par le travail de fond de Pierre Rousseau, conseiller stratégique de la banque, co-finance les grands projets d’infrastructure durable comme les parcs Eoliens ou les grandes fermes d’aquaculture.

Conclusion

A l’origine, les Océans avaient été les « oubliés » du programme mondial de l’environnement des Nations Unies et de son document SDG. En rattrapant cet oubli et en intégrant les Océans dans son plan mondial, les Océans retrouvent une légitimité dans leur contribution à la santé de la planète: nous avons 10 ans pour sauver les Océans et leurs habitants. Cette prise de conscience grandit et l’urgence fait naître des projets économiques enthousiasmants. C’est tout une chaîne de valeur qui se met en place et le monde des investisseurs et financiers en fait partie. Mais s’il ne fait aucun doute que l’économie des Océans est en pleine croissance, le défi sera celui de réaliser une croissance durable et respectueuse des Océans. Sans gouvernance mondiale des Océans, c’est une vraie inquiétude pour beaucoup.

Comments are closed